Firstly, I’d like to thank you for trusting me to serve as your representative in the General Assembly for another session. It’s an honor that I do not take for granted. I am running for reelection this year, and I’m asking for your vote in the upcoming May 21 primary and in the general election in November.

While the 2024 session concluded on March 28, I’ve waited a few weeks to finalize this legislative summary to make sure I have an accurate accounting of the bills that passed both chambers by the end of Day 40 and what was included in the final version of these bills. Furthermore, Governor Kemp’s final day to veto bills was last Tuesday, so we now have a complete list of the law that goes into effect.

I’m including a link to each bill on the General Assembly website in case you want to read the entire legislation. Finally, please note that this is not a complete list of all legislation passed this session. I am including those that I think would be of most interest to the people in the 156th district.

Fighting Inflation, Lowering Taxes, Balanced Budget

HB 581 is a homestead valuation freeze. Pending voter approval of a Constitutional Amendment, the act allows counties to provide a statewide homestead valuation freeze. This would limit the appreciation of property values to the inflation rate and protect taxpayers from runaway property taxes. This act also provides for a special local option sales tax for counties and municipalities to provide for property tax relief.

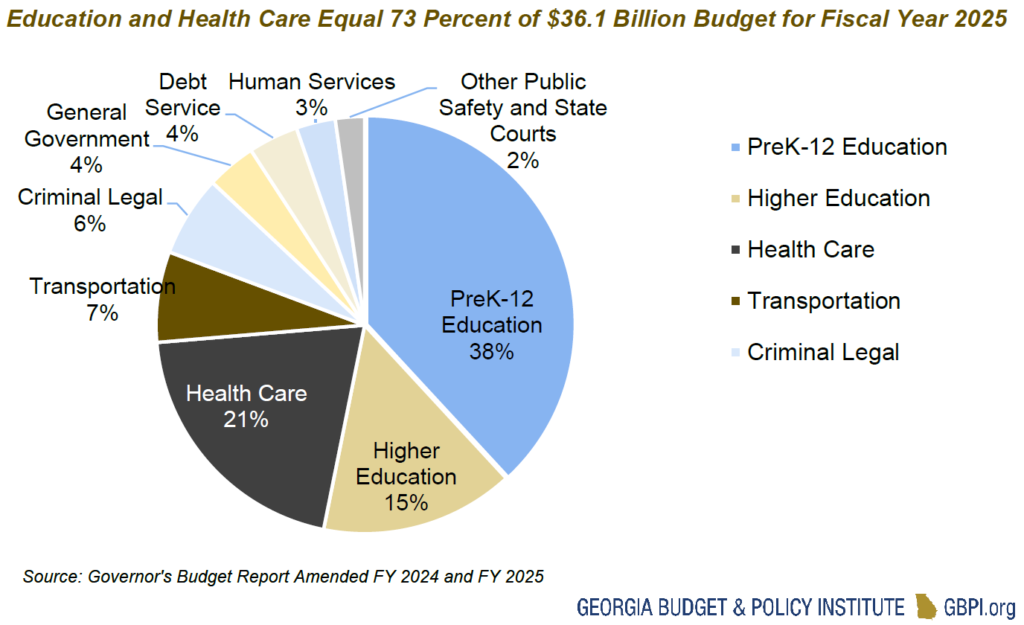

HB 919 is the “Big Budget” and takes effect July 1, 2024. While many people do not realize it, the only constitutional obligation of the General Assembly each year is to pass a balanced state budget. On the last day of the session, we did just that with the passage of the Fiscal Year 2025 (FY 2025) budget. Based on a revenue projection of $36.1 billion, this budget represents an historic increase of 11.4% over the previous fiscal year’s budget. Its passage marks a significant milestone in Georgia’s commitment to addressing the diverse needs of its citizens and reflects a robust investment across various sectors for the state’s growth and prosperity.

Here’s a chart that shows how your tax dollars are spent on the macro-level:

I serve as vice-chairman of the Education subcommittee for Appropriations, so I’ll highlight that area. The FY 2025 budget demonstrates a commitment to education, prioritizing key initiatives essential for advancing K-12 instruction. Notably, HB 919 fully supports the Quality Basic Education (QBE) program with an allocation of $14.1 billion in state funds. This budget also includes measures to:

- boost teacher salaries, earmarking $373.6 million to raise the state base salary schedule by $2,500. Teacher salary increases now total $9,500 over the last 5 years making Georgia the southeast’s leader in teacher pay.

- provide salary increases for school nutrition workers, bus drivers, school nurses and RESA staff.

- give $1,000 salary supplements for school custodians.

- prioritize literacy with $6.1 million for reading grants including literacy coaches.

- allocate $45,000 to each school for the School Security Grants program. This will become annual funding that schools can use for security upgrades, school resource officers, and other safety investments.

- provide $200 million for student transportation, addressing increased operating costs.

- set aside an additional $1 million for the Communities in Schools program to support students with a focus on improving attendance, behavior, and graduation rates.

I would like to commend and thank Senator Blake Tillery (R-Vidalia) for his dedicated work as Senate Appropriations Chairman. He works tirelessly around the year to make sure the state maintains a balanced, fiscally responsible budget. Furthermore, House Appropriations Chairman Matt Hatchett (R-Dublin) has shown excellent leadership and steadfastness in the budgeting process. The state budget must originate in the House, and Chairman Hatchett put together a great one this year. Georgia is in good hands!

HB 1015 reduces Georgia’s state income tax. It reduces Georgia’s income tax to 5.39% effective January 1, 2024, putting more money in the pockets of hardworking Georgians. It will be reduced by 0.10% annually beginning on January 1, 2025, until the rate reaches 4.99%.

HB 1021 eases the tax burden on Georgia parents and caretakers by increasing the income tax dependent exemption from $3,000 to $4,000.

HB 1023 reduces state income tax on businesses by simplifying Georgia’s tax code for entrepreneurs. Going forward, it will match the business income tax rate to the individual income tax rate. It also further extends the filing deadline for businesses to one month beyond the federal deadline. This legislation is effective July 1, 2024 for income tax year beginning January 1, 2024.

Combating Illegal Immigration

HB 1105, the Georgia Criminal Alien Track and Report Act, requires Georgia law enforcement to send information relating to immigration status of any person in their custody in the country illegally to federal immigration officials, subjecting those who fail to do so to criminal penalty and loss of certain state funds. These requirements have been in law but without the penalty provisions.

Keeping Communities Safe

HB 181 provides for enhanced penalties for the improper sale or distribution of prohibited forms of kratom beginning on July 1, 2024. The bill makes it a crime to knowingly sell or transfer any kratom product or kratom extract to a person under the age of 21. It also bans:

1) the ingestion of kratom in a manner that employs a heating element, power source, or other chemical, electronic, or mechanical means, that can be used to produce vapor; or

2) selling, delivering, or assisting in the delivery of kratom that employs a heating or electric element.

All kratom that is sold must be behind the counter or in a secured display in a store. A violation of these provisions carries a misdemeanor penalty.

HB 827 increases the penalty for the crime of livestock theft to between two years and 15 years imprisonment and increases the maximum fine to $10,000. If the fair market value of the livestock is $100 or less, then the punishment is increased to a high and aggravated misdemeanor. The commissioner of the Department of Agriculture is provided with authority to enforce this crime.

HB 926, the Second Chance Workforce Act, allows a traffic court judge to reinstate an accused person’s license when it was suspended because of a failure to appear, and when the accused has scheduled a new date to appear before the court, has appeared in court for a hearing, arraignment, or waiver of arraignment and entry of plea, or when the charge has been fully adjudicated.

The bill also adds battery against a healthcare worker or emergency health worker to the list of crimes that constitute a “serious delinquent act” by a minor and must be considered when determining whether to detain the child.

HB 1017, the Georgia Squatter Reform Act, creates the offense of unlawful squatting when someone enters and resides on the land or premises of the owner without the owner or rightful occupant’s knowledge or consent. A person who violates this provision will receive a citation advising that person to present documentation within three business days that authorizes presence on the premises. If the person is unable to do so, the person will be subject to arrest for criminal trespass and will be guilty of a misdemeanor. If a person does provide documentation, a hearing will be set within seven days to determine its validity. If the documentation is found to be fraudulent, that person will be subject to removal, arrest, and fined based on the fair market monthly rental rate of the premises.

HB 1033, the ‘Utility Worker Protection Act,’ enhances penalties for protection of utility workers harmed while acting within the scope of their employment. The bill includes independent contractors and applies to both private and public entities. The sentencing enhancement is added to the following crimes:

- simple assault (high and aggravated misdemeanor),

- aggravated assault (between three and 20 years imprisonment),

- simple battery (high and aggravated misdemeanor).

- aggravated battery (between one and 20 years imprisonment), and

- battery (high and aggravated misdemeanor).

SB 10 makes it a misdemeanor offense to knowingly be present and facilitate a drag race. This can include using a vehicle to block a portion of the roadway nearest to the race. Fines for reckless stunt driving increase.

SB 63 prohibits a local jurisdiction from creating a bail schedule, or policy, that mandates releasing a person from jail on unsecured judicial release. The bill adds offenses to the definition of “bail restricted offenses”, which require a monetary value to be set for bail, including misdemeanors and second or subsequent violations of certain crimes. No person is eligible to be released on unsecured judicial release if he or she was charged with a bail-restricted offense. A person arrested for any offense who has been convicted of a felony within the past seven years is not eligible for an unsecured judicial release.

SB 421 enhances penalties for “swatting” and drive-by shootings. This legislation is in response to numerous reported incidents in Georgia and across the country of “swatting” or using deception to send an armed police response to a false emergency. Penalties include:

- first conviction – misdemeanor.

- second conviction – five to ten years imprisonment.

- a third or subsequent conviction – 10- and 15-years imprisonment, a minimum fine of $25,000, or both.

If the location of response is a person’s home or a place of worship, then a first violation is now treated as a felony with imprisonment of between one and 10 years, a minimum fine of $5,000, or both. A person who is convicted of this crime is now automatically liable for restitution to any affected person or entity for reasonable costs or damages associated with the offense, including damage to property and expenses to treat bodily injuries.

The second part of SB 421 is targeted towards drive-by shootings. The crime of aggravated assault now includes the discharge of a firearm, without legal justification, after immediately exiting a vehicle towards another vehicle or an occupied building. Furthermore, the crime of criminal damage to property in the first degree is broadened to include when someone discharges a firearm, without legal justification, while inside a vehicle or after immediately exiting and when that person causes damage to a building.

The bill also creates a new crime of drive-by shooting when a person who is either in a motor vehicle or is close to a motor vehicle that he or she used to drive to the location, discharges a firearm at another person, motor vehicle, occupied dwelling, or dwelling that the person should have known to be occupied, with the intent to injure or damage the property of another. The penalty is imprisonment of between five and 20 years. The crime of drive-by shooting is added to the list of crimes within the definition of “racketeering activity” under the criminal gang statute.

SB 465 addresses fentanyl-related deaths. It creates the crime of aggravated involuntary manslaughter that occurs when a person intentionally manufactures or sells a substance containing fentanyl and a person who takes or uses that substance dies from the fentanyl overdose. In a prosecution for this crime, the government will not need to prove that the defendant knew fentanyl was in the drug. A person who violates this offense will be guilty of a felony and subject to imprisonment of between 10 and 30 years.

The bill also creates a felony crime for unlawfully possessing, purchasing, delivering, selling, or possessing with intent to sell or deliver a pill press or tableting machine when the person has reasonable cause to believe it will be used to manufacture a controlled or counterfeit substance. A person who commits this crime will be subject to imprisonment of between one and 10 years.

SB 493 aims to protect minors from sex offenders. It increases the penalties for intentionally photographing a minor without the consent of the parent or guardian. Further, a sex offender is prohibited from owning or operating a drone with the intent to photograph or observe any person in a manner that violates his or her reasonable expectation of privacy.

Supporting First Responders

HB 451 requires a public entity to provide supplemental, illness-specific insurance to certain first responders diagnosed with occupational PTSD. Coverage will be available once per one’s lifetime and include a $3,000 cash benefit and an income replacement disability benefit if needed.

SB 334 allows benefits received by eligible firefighters under the ‘Helping Firefighters Beat Cancer Act’ to be transferred when an employee transfers to another fire department within the state.

Second Amendment Rights

HB 1018 – Georgia Firearms Industry Nondiscriminatory Act – protects Georgians’ Second Amendment rights by making it unlawful for a financial institution to require the coding of credit and debit card transactions to specifically identify firearms purchases.

Rural Georgia Specifically

Line items included in either the AFY 2024 budget or the FY 2025 budget include:

- The General Assembly agrees with the governor to provide $23.9 million to continue the Rural Workforce Housing program. The program provides funding for projects that expand or improve the housing stock to address current workforce housing needs.

- House Bill 915 provides $100 million to the Regional Economic Business Assistance program for economic development projects and $100 million to the OneGeorgia Authority for rural economic and site development. These programs help to make Georgia more attractive to businesses seeking to expand or relocate.

- The General Assembly supports the governor’s recommendation in the Amended FY 2024 budget to provide $250 million to the Georgia Fund for low-interest loans for water and wastewater infrastructure development in local communities.

- The General Assembly provides the Department of Agriculture $150,000 for the Feral Hog Task Force.

- House Bill 916 provides $1.7 million to the State Forestry Commission for grants to counties with more than 20,000 acres of state-owned land under O.C.G.A. 48-14-1.

- The General Assembly instructs the Department of Community Health to conduct an actuarial study on prescription drug reimbursement to independent pharmacies in the State Health Benefit Plan to include an examination of practices by the plan’s contracted pharmacy benefits manager (PBM) for the outpatient pharmacy benefits. We provided $6.2 million in one-time funds for a $3 per prescription dispensing fee for independent pharmacists awaiting the outcome of the SHBP PBM study.

HB 82 is the rural physician tax credit bill. The purpose is to incentivize physicians and dentists to begin practicing in rural areas. It creates a tax credit of up to $5,000 for rural healthcare professionals, defined as physicians and dentists operating in a rural county. The tax credit may be claimed for up to five years, provided that the healthcare professional continues operating in a rural county. No healthcare professional practicing in a rural county on or before May 15, 2023, is eligible for the tax credit unless they have practiced in a non-rural county for at least three years.

HB 244 makes it legal to hunt bobcat and fox using electronic calls or sounds.

HR 1166 creates the House Study Committee on the Exchange, Storage, and Bond Coverage of Agricultural Products, Grain, and Livestock and shall be comprised of seven members of the House of Representatives to be appointed by the speaker of the House of Representatives. The committee will stand abolished on December 1, 2024.

SB 420 addresses foreign adversary ownership of agricultural land. It prohibits a person who is not a U.S. citizen / legal resident or is an agent of a foreign government designated as a foreign adversary and has been out of the country for a period preceding the acquisition of land from acquiring directly or indirectly any possessory interest in agricultural land or land within a 10-mile radius of a military installation, excluding residential property.

Any possessory interest in agricultural land acquired by a nonresident alien through inheritance will be disposed of within one year after acquisition. Any interest acquired in the collection of debts will be disposed of within two years after acquisition.

Veterans’ Affairs

DBHDD receives $500,000 in the FY 2025 budget to support homeless Georgians by funding behavioral health services and rapid rehousing. The Department of Veterans Service is also appropriated $121,250 for a coordinator to work with homeless veterans.

SB 449 requires the Department of Community Health, in collaboration with the Department of Veterans Service, to create a program in which military medical personnel can be certified as nurse aides, paramedics, cardiac technicians, emergency medical technicians, or licensed practical nurses without having to meet certain additional requirements. The term “military medical personnel” is added by the bill and relates to those who have relevant experience as a medic, medical technician, or corpsman, within the U.S. Army, Air Force, Navy, or Coast Guard.

Strengthening our Elections

The General Assembly provides the Secretary of State’s Office with $110,000 to improve election security by adding watermarks to all ballot paper. HB 915 also includes $3 million for the Secretary of State’s Office to replace the Uninterruptible Power Supplies (UPS) for 8,000 voting machines statewide.

HB 974 requires ballots to be printed on security paper that includes a visible watermark. The bill requires the Secretary of State to maintain a state-wide program for the posting of digital images of election ballots. The bill requires a minimum scan resolution of 200 dots per inch (DPI) for scanned paper ballots and 600 DPI, or the highest resolution possible within the certified voting system, for scanned absentee ballots.

The bill sets the risk-limiting audit probability limit at a decreasing percentage beginning with eight percent in 2024 and concluding with a rate of five percent or less in 2028. The bill clarifies which contests, in addition to specified top of the ballot contests, must be selected for a risk-limiting audit and how they are selected.

It requires the SOS to create a pilot program for the auditing of paper ballot images using optical character recognition or related technology to verify the human-readable text portion of a ballot.

HB 1207 does several things related to election integrity and security.

- requires any person employed by a county election superintendent for election-related duties to be a United States citizen.

- requires election superintendents to make a ballot proof available within 24 hours to any candidate appearing on the ballot so the candidate may verify the information.

- allows election superintendents to take specified conditions into consideration when planning for the number of voting booths or enclosures to provide for each election.

- provides access to poll watchers for specified voting locations and activities.

- prohibits the use or threats of violence that would prevent or interfere with the ability of election officials or poll watchers to execute election duties.

SB 189 , which passed along party lines, strengthens the integrity, transparency, and accountability of our elections. This legislation does several key things:

- protects against fraud by allowing for voter challenges of those who have moved out of Georgia.

- stops the use of QR codes or bar codes for counting ballots.

- tightens up the chain of custody of ballots and expands the number of election contests that are subject to risk limiting audits.

- removes the Secretary of State as a non-voting ex officio member of the State Elections Board.

- requires all verified and accepted absentee ballots and all ballots cast during advance voting to be tabulated, with the results reported within one hour of polls closing on election day.

- prohibits specified statewide and local election officials with a conflict of interest from transacting election-related business in certain instances.

- allows any political party that has obtained ballot access for the office of presidential elector in at least 20 other states to qualify candidates and access the general election ballot for such office.

- The bill allows homeless electors to utilize the registrar’s office in their county as their mailing address for election purposes. The bill revises certain provisions relating to residency changes.

SB 212 removes election activities and duties from the powers of probate judges. The bill directs any county with a probate judge acting as the election superintendent to create a board of elections and registration. The bill provides for the composition and administration of such boards.

Supporting & Protecting Our Children

The General Assembly appropriated $608,000 to DBHDD to support children and adults with autism through enrichment and employment opportunities, psychiatric services, and screening.

Georgia Family Connection receives $596,250 in the FY 2025 budget to increase county allocations from $52,500 to $56,250.

HB 409 addresses safety of school children by strengthening the Code pertaining to passing a stopped school bus picking up children. Violators will be guilty of a high and aggravated misdemeanor and will either be given a fine of at least $1,000, face confinement of no less than 12 months, or both upon conviction.

HB 993 safeguards minors from online grooming. The legislation creates a criminal penalty for adults who groom a minor in an attempt to engage in a sexual offense or in human trafficking if the action or the target of the action have a connection to Georgia.

HB 984 allows for developmentally or physically disabled individuals to remain on their parent or guardian’s insurance beyond the usual cutoff age.

HB 1026 designates the Southeast Georgia Soap Box Derby in Lyons as Georgia’s official soap box derby. Thank you to everyone under the Gold Dome and around the state who offered support and encourage during the two-year process to get this legislation through the process.

SB 335, the ‘Safeguarding Adopted Children from Sexual Violence Act,’ expands the crime of incest to include those whose familial relationships are created by adoption.

SB 376 requires timely permanent placement of a child removed from his or her home.

FOster Care and DFCS

The Office of the Child Advocate is appropriated $99,780 in the Amended FY 2024 budget to improve legal representation that foster children and their families receive.

HB 915 provides $3.2 million to the Department of Human Services to improve the SHINES child welfare case management system and $1.7 million for the Georgia Gateway benefits eligibility system.

Investing in Educational Opportunities

HB 916 , as mentioned above:

- raises teacher pay $2,500, totaling $9,500 in increases over 5 years making Georgia the Southeast’s leader in teacher pay.

- fully funds QBE with the largest amount of money ever going to our schools.

- provides a 4.1% raise for many other school employees like nutrition workers, bus drivers, school nurses, RESA staff, etc.

- provides every school a $45,000 school security grant annually to help ensure the safety of teachers, staff, and students.

- appropriates $750,000 for a mentorship program for new teachers to increase retention rates.

HB 874 requires all public schools to have a functional automated external defibrillator (AED) on site at all times during school hours and during any school-related function.

HB 995 local school systems to provide an optional nationally recognized multiple-aptitude battery assessment (such as the Armed Services Vocational Aptitude Battery or ASVAB) for high school juniors or seniors at least once per school year.

SB 233, the Georgia Promise Scholarship Act, provides that, IF a student attends a school in the lowest 25% as determined by the Governor’s Office of Student Achievement, then their parents MAY decide that a different situation would better serve the student. In this situation, only the QBE portion ($6,500) of state funds would be used for the scholarship. All local money, federal money, and state non-QBE money would still go to the resident public school. Also, we’ve ensured that any school seeing a shift in funds as a result of a parent taking advantage of this act would be eligible to receive additional funding through the Public School Tax Credit.

Other things to point out in SB 233:

- teacher pay raises are codified

- public schools will be allowed to use state capital construction dollars for Pre-K construction or improvement projects, etc. Currently, this is not allowed.

- the Public School Tax Credit will allow S-corps to participate. This would add an estimated $10 million which would go to schools in the lowest 25%.

- participating private schools must demonstrate fiscal soundness. They must either be accredited or in the accreditation process. They must submit regular reporting to prove they comply, and they must test their students each year as public schools do.

SB 464, the School Supplies for Teachers Program, provides reimbursement opportunities for teachers when making certain qualified school supply purchases.

Tort Reform & Related Matters

HB 994 provides that boat operators are liable for injury or damage when negligence occurs on the part of the operator. A rented boat operator is liable for negligent operation. Boat livery owners are required to carry insurance with coverage of at least $500,000 per person per occurrence and $1,000,000 per event.

HB 1409 pertains to the legal liability of inpatient mental health providers in the delivery of care to individuals under the age of 21 in the custody of the Department of Human Services. Mental health care providers will not be held liable unless gross negligence occurs. In such cases, the jury will be instructed to consider the patient’s medical history, previous provider-patient relationships, and circumstances surrounding delivery and provision of services.

SB 426 permits a claimant to join a motor carrier and insurance carrier in the same action only when one or more motor carriers in question are insolvent or bankrupt or in certain other situations.

Expanding Access to Quality, Affordable Healthcare

HB 916 provides $500,000 for infant mortality research as part of Morehouse School of Medicine’s Center for Maternal Health Equity.

Rural Support

HB 872 allows for dental students to be eligible for the service cancelable loan program when they agree to practice in rural counties with a population of 50,000 or less.

Behavioral and Mental Health

The Amended FY 2024 budget provides $15.5 million to the Department of Behavioral Health and Developmental Disabilities (DBHDD) for the construction of a new child and adolescent crisis stabilization unit in Savannah. The FY 2025 budget includes $125,000 for initial operating expenses.

The Amended FY 2024 budget includes $664,462 for a new 30-bed jail-based program that would provide services to restore inmates to competency and address the forensic services backlog. HB 916 includes $2.5 million to expand jail-based competency restoration programs.

House Bill 915 appropriates $60 million to DBHDD to address capital needs across the state’s five psychiatric hospitals.

The FY 2025 budget includes $3.2 million in the Department of Behavioral Health and Developmental Disabilities (DBHDD) for the Macon Crisis Stabilization Diagnostic Center, which will serve as the state’s first crisis support center for adults with intellectual and developmental disabilities.

The Georgia Apex program is supported with $1 million in FY 2025 to expand to additional schools. The program provides several services utilizing mental health professionals, including community education, at home visits, virtual visits, group counseling, and individual counseling.

SB 480 provides student loan repayment to mental health and substance use providers who provide services to underserved youth or who practice in an unserved geographic area. This loan repayment is subject to appropriations.

Professional Licensure

The Amended FY 2024 budget includes $145,600 for the Secretary of State’s office for the Professional Licensing Division to hire temporary employees to address the program’s backlog related to licensure applications.

HB 880 brings Georgia into compliance with the federal ‘Servicemembers Civil Relief Act’ and allows the spouse of a servicemember to practice their occupation without a license so long as that spouse:

1) holds a current license to practice the occupation in another state,

2) is in good standing in the other state,

3) has filed an application for an expedited license by endorsement along with the military orders of the servicemember, which can both be filed prior to moving to Georgia,

4) is hired by an in-state employer that may lawfully hire the spouse to engage in the occupation, and

5) has their information verified by the in-state employer.

If a spouse is not issued a license by endorsement within 30 days of filing the application, then they can continue to work for the in-state employer without being licensed. If the spouse is denied an expedited license by endorsement, then that spouse will no longer qualify to engage in the practice of the occupation.

SB 354 removes cosmetology licensing requirements for employees who only shampoo, blow-dry, or style hair. The bill also revises the exemption for cosmetics so that a person who solely applies cosmetics is no longer required to be licensed.

Improving the Quality of Life for All Georgians

HB 30 provides for the definition of antisemitism. It requires state agencies and departments to consider such definition when determining whether an alleged act was motivated by discriminatory antisemitic intent.

HB 404 is the Safe at Home Act. It applies to residential lease agreements that are entered into or renewed on or after July 1, 2024. Rental properties are required to be fit for human habitation. The bill includes air-conditioning as a utility that cannot be shut off prior to an eviction action. Landlords are prohibited from requiring a security deposit that exceeds two months’ rent. A tenant, when they fail to pay charges owed to landlord, is afforded a three-business day written notice period prior filing for an eviction proceeding.

HB 617 is Georgia’s long-term statewide freight and logistics plan. It adds the development of a statewide freight/logistics implementation plan to duties of the director of planning at the Department of Transportation. The statewide freight/logistics implementation plan is based on a 20-year projection.

The legislation creates the Georgia Freight 2050 Program to be administered by GDOT to enhance the state’s investment in the statewide transportation freight network. The program will fund and support projects included in the freight plans identified in Georgia Code. Priority is given to capacity enhancements including:

- widening of interstates and non-interstate arterial roads,

- interchange, intersection, and other operational improvements,

- intermodal or multimodal capacity enhancements,

- railroad crossing access/safety improvements,

- commercial motor vehicle parking/safety improvements, and

- projects located in an international ocean trade zone.

HB 663, the “No Patient Left Alone Act,” states that all patients have the right to have an essential caregiver physically present while that patient is in the hospital or facility. Importantly, these caregiver rights can not be terminated, suspended, or waived by the facility, the Department of Public Health, or any governmental entity, regardless of emergency declarations by the governor. This legislation was introduced in response to the COVID-19 pandemic, which prevented many Georgians from visiting their loved ones, even during the final days of their lives. This legislation ensures that patients are never left alone without their family or caregiver by their side to provide crucial support and advocacy.

HB 1010 increases the number of hours of paid parental leave for state employees and employees of local education agencies from three to six weeks. Paid parental leave can be used for the birth of a child or the foster and adoption placement of a child by both mothers and fathers.

HB 1053 bans state government agencies from accepting a payment using a digital currency issued by the federal reserve bank or a foreign central bank. It prohibits governmental agencies from participating in any test of a central bank digital currency.

HB 1339 modifies and updates statutes relating to the state’s certificate of need (CON) processes.

HR 1554 creates the House Study Committee on Navigable Streams and Related Matters.

SB 369 authorizes a vehicle license plate celebrating America’s 250th birthday. Special plates will be issued to commemorate the celebration based on a design selected from submissions from Georgia middle school students.

Caring for the Elderly

The General Assembly funds an additional 275 non-Medicaid home and community-based services slots in the FY 2025 budget to help keep older adults in their homes longer with supportive services.

Employee Retirement System:

House Bill 915, the Amended FY 2024 budget, includes $500 million for the Employees’ Retirement System of Georgia, to improve the system’s overall health and funding ratio, which will provide a greater COLA benefit to retirees in future years.

On July 1, 2024, retired ERS members will receive a COLA of 0.25%.

In FY 2025 the employer contribution rates are as follows:

- GSEPS: 25.51%

- New Plan: 29.20%

- Old Plan: 24.45%

Teachers Retirement System of Georgia:

The average monthly benefit is $3,485. Retirees receive a 1.5% COLA twice a year if the Consumer Price Index (CPI) is equal to or higher than when the member retired.

HB 1078 excludes the Georgia Program of All-Inclusive Care for the Elderly (PACE) as an applicable service within the definition of “adult day health services”. The bill provides additional opportunities with Georgia’s Medicaid program to provide comprehensive acute and long-term healthcare services to ensure continued community living for qualifying individuals.

HB 1123 would have increased protection of the elderly, however it was vetoed by Governor Kemp. It would have required district attorneys to establish an Adult Abuse, Neglect, and Exploitation Multidisciplinary Team, so long as it is funded through the Prosecuting Attorneys’ Council of the State of Georgia. The bill also would have created the elder justice coalition to create a law enforcement protocol, train officers when responding to instances of abuse of disabled adults or elder persons, conduct training related to disability, and partner with state agencies/organizations to promote awareness of holistic care.

SB 105 increases the benefit multiplier for Public School Employees Retirement System (PSERS) members from $16.50 to a minimum of $17.00 per month for each year of creditable service.

Dealing with Homelessness

DBHDD receives $500,000 in the FY 2025 budget to support Georgians experiencing homelessness by funding behavioral health services and rapid rehousing. The Department of Veterans Service is also appropriated $121,250 for a coordinator to work with veterans experiencing homelessness.

HB 916 includes $1 million for the Department of Community Affairs to create the affordable housing initiative. The initiative, under the State Housing Trust Fund, provides funds for organizations that help homeless individuals obtain stable, immediate housing in the short-term and achieve affordable housing in the long-term.

Local Legislation – Telfair County

Both of these acts require that the voters of Telfair County approve of them by over 50% on the November 2024 ballot.

HB 1141 provides a homestead exemption from Telfair County school district ad valorem taxes in an amount by which the current year assessed value of the homestead exceeds the base year value, if it does not exceed $25,000.

HB 1143 provides a homestead exemption from Telfair County ad valorem taxes in an amount by which the current year assessed value of the homestead exceeds the base year value, provided that it does not exceed $25,000.

I was happy to sponsor these two bills along with Representative Danny Mathis and Senator Blake Tillery after the acts were unanimously requested by the elected officials in Telfair County.

Conclusion

During the interim, my legislative colleagues and I will continue to examine current and emerging issues facing Georgians that may need to be addressed in next year’s session, which will begin on January 13, 2025. Please let me know how I can continue to support House district 156 and what issues are important to you in the months ahead at Leesa.Hagan@house.ga.gov.

Also, I am running for re-election, so you’ll see me campaigning from Fitzgerald to Cobbtown between now and November! I would be honored to earn your vote again. Thank you for allowing me to serve as your representative under the Gold Dome.

Regards,

Note: If you would like to read about bills that go into effect on July 1, 2024, specifically, you may do that here.