Early voting begins Tuesday, October 15. Among the important choices Georgia voters have in this general election are three ballot questions – two constitutional amendments and one statewide referendum. Also, at the end of this article, I’m including instructions on how any of you can check your voter status and obtain a sample ballot so you know exactly what to expect when you go to vote.

Ballot Question #1: Constitutional Amendment 1

HR 1022: This question provides for a general law statewide homestead exemption that may currently vary among political subdivisions.

Summary:

HR 1022 would allow for the implementation of a statewide homestead exemption that caps the annual assessments of home values at the rate of inflation. This would result in assessments for homesteaded properties being limited to an increase capped at the rate of inflation (CPI), with an initial opt-out period for local levying authorities (counties, cities, and schools). These levying authorities (counties and cities) where this cap takes effect would have access to an additional 1% sales tax that must be used for additional property tax relief – the extra penny of revenue must be fully offset by a further reduction in property tax.

How the question will appear on the ballot:

“Shall the Constitution of Georgia be amended so as to authorize the General Assembly to provide by general law for a state-wide homestead exemption that serves to limit increases in the assessed value of homesteads, but which any county, consolidated government, municipality, or local school system may opt out of upon the completion of certain procedures?”

Ballot Question #2: Constitutional Amendment 2

HR 598: This question provides for a statewide Georgia Tax Court.

Summary:

This constitutional amendment would replace the Georgia Tax Tribunal, which currently sits in the Executive Branch, with a Tax Court in the Judicial Branch. This is not creating more government; instead, it is moving a function of government that serves taxpayers between branches of government to improve efficiency.

Currently, if a taxpayer wishes to appeal a tax tribunal decision his or her only option is to go through the Superior Court in Fulton County, which is not set up to be an appellate court and is overrun with a lengthy trial calendar.

A Tax Court authorized under this amendment would allow for the first round of appeal to be made to the Georgia Court of Appeals – a purpose-built appeals court with a more streamlined and quick process for Georgians.

How the question will appear on the ballot:

“Shall the Constitution of Georgia be amended so as to provide for the Georgia Tax Court to be vested with the judicial power of the state and to have venue, judges, and jurisdiction concurrent with superior courts?”

Ballot Question #3: Referendum A

HB 808 – This question would raise the amount of tangible personal property tax exemption from $7,500 to $20,000.

Summary:

The referendum would increase the ad valorem taxation exemption on tangible personal property for businesses in Georgia from $7,500 to $20,000. It would reduce taxes for Georgia businesses by updating the exemption amount for the first time in years to account for the effects of inflation.

How the question will appear on the ballot:

“Do you approve the Act that increases an exemption from property tax for all tangible personal property from $7,500 to $20,000?”

Instructions for checking your voter registration and obtaining a 2024 sample ballot

To avoid surprises at your polling place, please check your voter registration and obtain a sample ballot so you can review your choices.

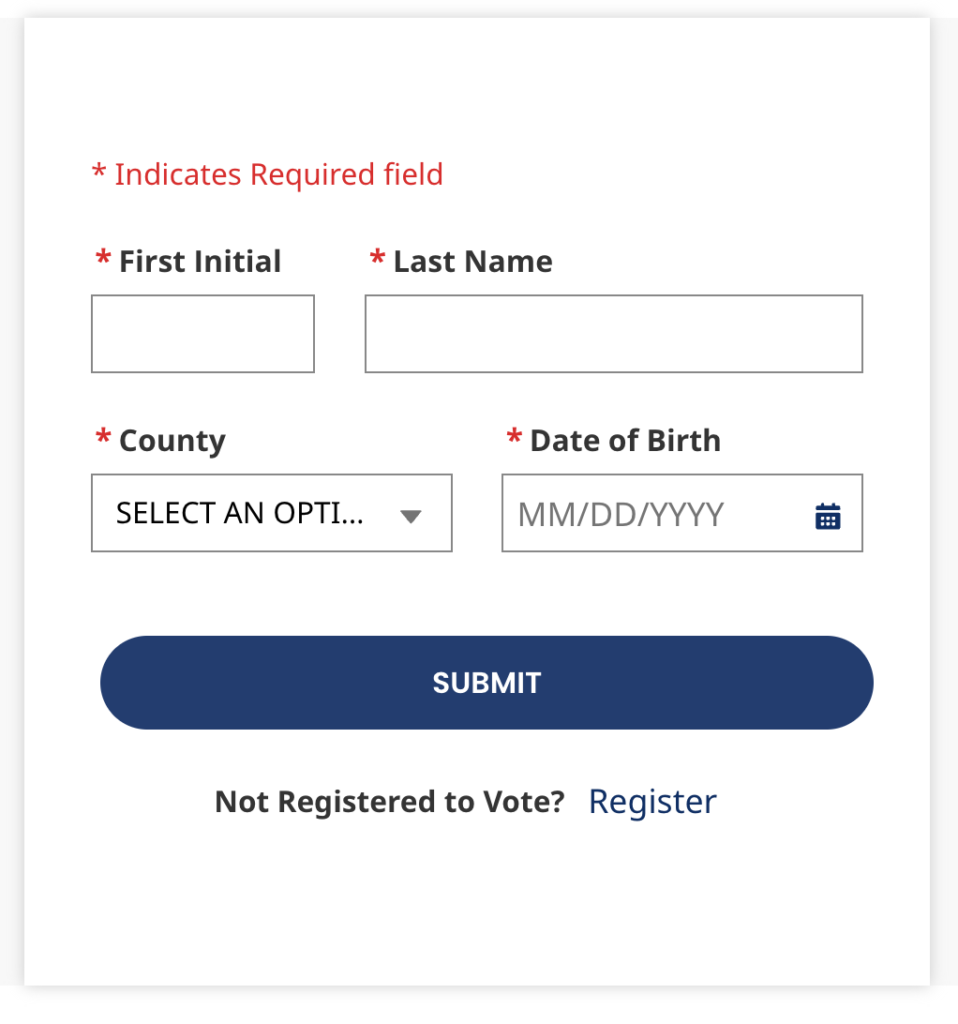

- Visit the Georgia Secretary of State’s Election Division.

- Enter the required information and select “Submit.”

- Scroll down a bit and select “View My Sample Ballot.”

- Select “View General Sample Ballot.”

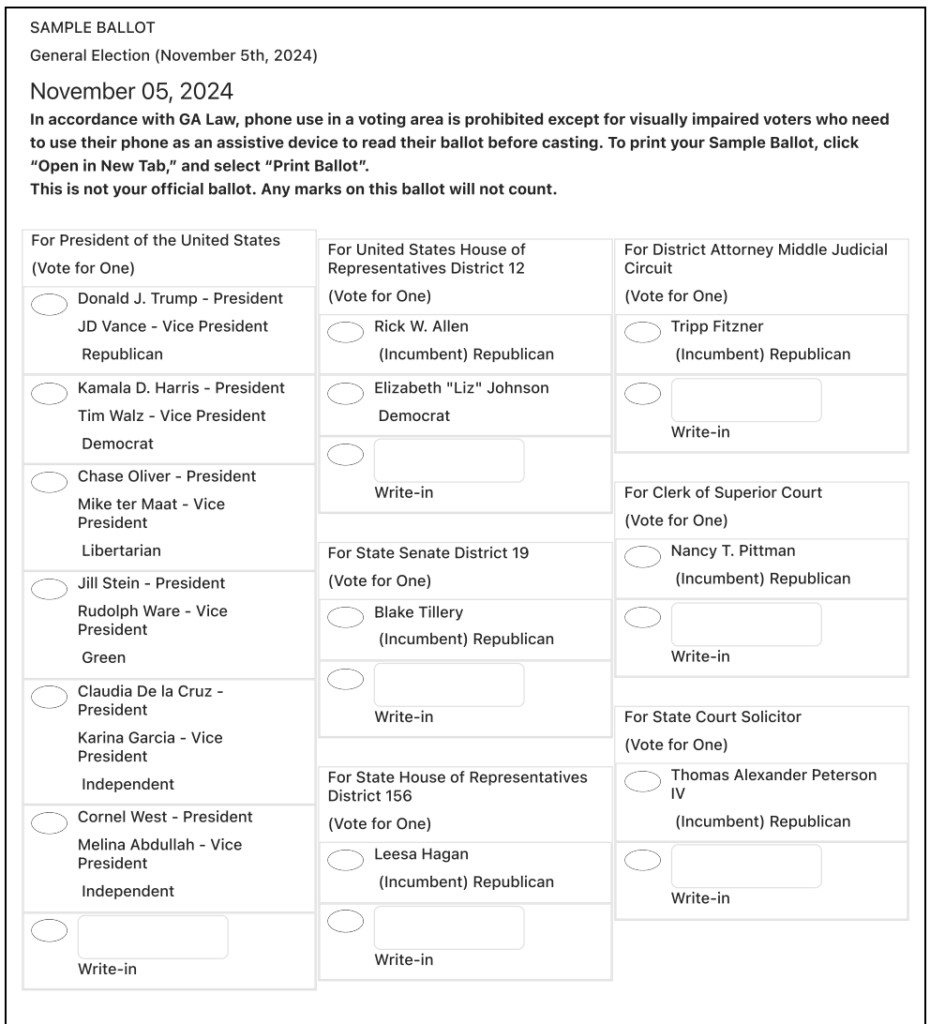

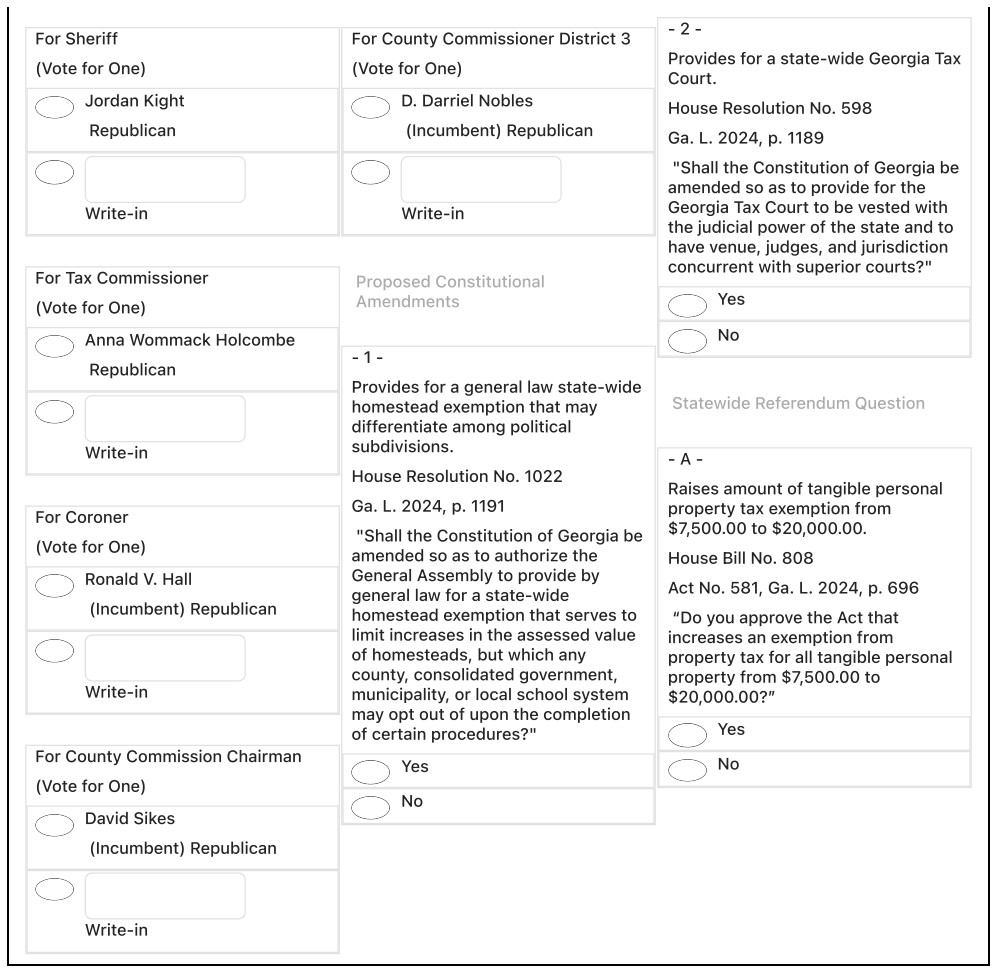

- If you’d like to print the sample ballot, click on “Open in a New Tab” and click “Print Ballot.” It should look something like this but could vary depending on your county or municipality:

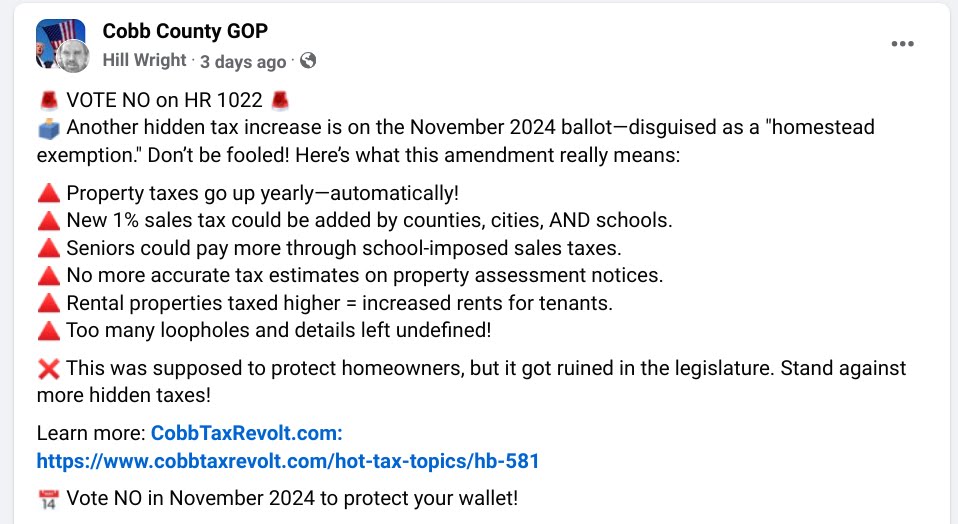

Update: Misinformation Regarding Question #1

There is a lot of misinformation floating around regarding ballot question #1. How you choose to vote on it is your choice, but I want you to be informed of what the amendment would actually do if it receives enough votes. I do NOT want you to be misguided by people who either do not understand the ballot question and the bill OR are intentionally attempting to mislead.

I’m going to address a post from a GOP group (see photo above) point by point.

1) Property taxes typically increase every year already – regardless of whether this amendment passes. We all know this. This amendment would CAP HOW MUCH they can be raised by tying increases to the inflation rate.

2) IF a city or county chooses to participate in this homestead assessment cap, THEN they have the option to add a 1% sales tax (FLOST). If they chose to do so, it can ONLY be used to offset lost property tax revenue due to assessment cap – no more. I would rather have everyone who does business in a county/city and uses the roads and other infrastructure SHARE the cost of maintence through sales tax than to have property owners carry all of that tax burden themselves. A sales tax also captures revenue from those who do not own property and who may not pay income tax.

3) This point implies that seniors would be targeted somehow by the potential 1% FLOST. This is absolutely untrue.

4) This makes no sense. I’ve heard from many constituents that feel like the dramatic increases in property assessments we’ve seen recently are not accurate. Tying assessments to the rate of inflation seems like a reasonable way to ENSURE they are accurate.

5) The fact we have “homestead exemptions” in place at all as we currently do in Georgia by definition means that taxes charged to NON-homesteaded property (i.e. rental property, second homes, whatever) will naturally be higher. That’s the whole point of the homestead exemption. Is the Cobb GOP proposing that we eliminate homestead exemptions altogether? I would NOT be in favor of that.

6) There is no way to define every detail or close every loophole in any legislation. Anyone who tells you it can be done is not being completely truthful with you.

Here’s what I can tell you: We heard from constituents that you don’t want huge surprise increases in your property assessments. I don’t want that either. This ballot question provides a way to make assessment increases more predictable.

If you like it, vote YES. If you don’t like it, vote NO. My goal is that you be informed by what is actually in the bill and not fooled by people who don’t know what they are talking about.

Update: Misinformation Regarding Question #2

Some of you may have received this “Alert” via text or email regarding ballot question #2. There is misinformation in this alert that needs to be corrected. Ballot question #2 is an amendment which would replace the EXISTING Georgia Tax Tribunal with a Tax Court. This is not creating a new court as this post states. It is moving the Tax Tribunal from the executive branch to the judicial branch, where it would then be called Tax Court.

This will make the process much more efficient for taxpayers. Here’s why: right now, if a taxpayer wishes to appeal a tax tribunal decision, his or her only option is to go through the Superior Court in FULTON COUNTY. Fulton County Superior Court is not set up to be an appellate court and is seriously overrun with a lengthy trial calendar.

A Tax Court authorized under this amendment would allow for the first round of appeal to be made to the Georgia Court of Appeals – a purpose-built appeals court with a more streamlined and quick process for Georgians. I believe efficiency for Georgia taxpayers is important and makes good sense. And, again, the amendment does not create more government. It simply moves it to the judicial branch where it makes more sense and would give taxpayers a resolution more quickly.

For the person who posted the “alert” to say Georgians do not need a Tax Court either shows she does not understand the bill or she thinks citizens around the state are satisfied with appealing to the overrun Fulton County Superior Court in these matters.

Personally, I am voting YES on all three statewide ballot measures. I only want you to be informed with the facts so you can decide what you think is best for you and your family.

Thank you so much for your support and prayers. I’m humbly asking for your vote in this election and asking that you vote Republican up and down the ballot. As always, if you need any assistance that my office can provide, please contact us or see my Constituent Services page.

Kind regards,